Important Information

This information is provided for general educational purposes only without regard to your particular investment needs. This material, including any attachments or hyperlinks, should not be taken as investment or tax advice of any kind whatsoever (whether impartial or otherwise) on which you may rely for your investment decisions, nor be construed as an offer, solicitation or recommendation for any investment strategy, product or service. Investors should consult their financial and tax adviser before making investments in order to determine the appropriateness of any investment discussed herein.

Material authored by any particular Artisan Partners individual or team represents their own views and opinions, which may or may not reflect the views and opinions of Artisan Partners, including its autonomous investment teams or associates. Statements are based on current market conditions and other factors, which are as of the date indicated and are subject to change without notice. While this information is believed to be reliable, there is no guarantee to the accuracy or completeness of any statement in the discussion.

All investments are subject to risk, which includes potential loss of principal. Past performance is not indicative of future results.

This material may reference index or other information that is subject to copyright by its respective service provider, including the following: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI. Frank Russell Company ("Russell") is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell's express written consent. Russell does not promote, sponsor or endorse the content of this communication. The S&P 500 and S&P UBS Leveraged Loan Indices are products of S&P Dow Jones Indices LLC (“S&P DJI”) and/or its affiliates and has been licensed for use. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, Inc. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). None of S&P DJI, Dow Jones, their affiliates or third party licensors makes any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2025, J.P. Morgan Chase & Co. All rights reserved. Source ICE Data Indices, LLC, used with permission. Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and, along with the ICE BofA trademarks, has been licensed for use by Artisan Partners Limited Partnership. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See www.artisanpartners.com/ice-data.html for a full copy of the Disclaimer. The index(es) are unmanaged; include net reinvested dividends; do not reflect fees or expenses; and are not available for direct investment.

© 2025 Artisan Partners. All rights reserved.

Give Me Shelter: What a Rising Rate Environment Might Mean for Credit Markets

With vaccination rates ramping and the economy beginning to emerge from its COVID-induced slowdown, the days of record-low interest rates are likely numbered—which raises questions about the broader fixed income environment. While rising rates could mean conventional fixed income areas are in for a relatively rough ride, they could also provide an interesting environment for high yield and leveraged loans, which have historically fared relatively well as rates rise thanks to some potentially overlooked considerations.

As investors have rushed to price in their expectations for booming global growth and higher inflation, wild swings in Treasury yields have become commonplace—despite the Fed’s signaling its commitment to accommodative policy for the foreseeable future. Hence benchmark 10-year Treasury yields’ steady march higher, increasing more than 80bps year to date.

So far, conventional fixed income segments like investment-grade credit have borne the brunt of the market move, with the ICE BofA US Corporate Index declining more than 4.5%—wiping out nearly nine months of gains. The move has even been more acute among long bonds, which are down 9% year to date and are on pace for one their worst years ever.

Meanwhile, high yield credit has been relatively insulated from the recent rate swings, with positive returns and relatively little correlation to core credit segments—which isn’t totally surprising given rising rates aren’t necessarily a bad thing for high yield credit. They tend to reflect an improving economic environment in which consumer spending is strong and corporate profits are rising. Because the primary risk with high yield bonds is default risk, a strong economy generally improves corporate fundamentals and issuers’ ability to service debt obligations—particularly for credit-sensitive segments, where the signal provided by rising rates is often more important than the movement in rates itself.

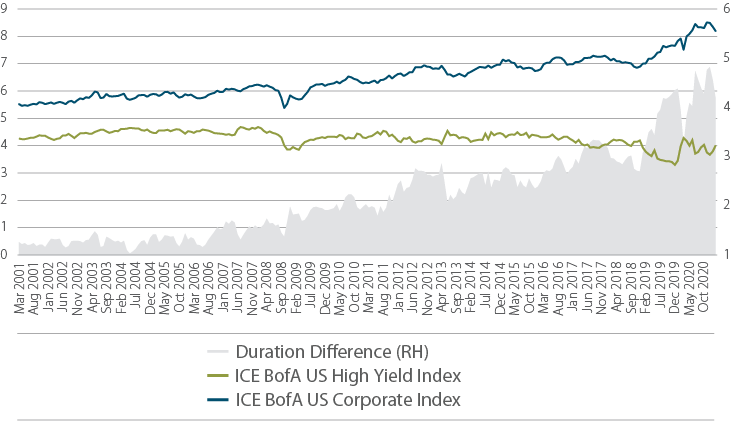

On a more technical level, high yield bonds also tend to hold up due to compositional differences between them and investment grade credit. High yield issuers tend to issue shorter-dated debt that is less sensitive to interest rate changes than high-grade issuers’ debt. And because high yield bonds typically come with higher coupons, they’re able to better absorb price declines caused by higher rates through tighter credit spreads. This difference in interest rate sensitivity shows up in duration: High yield bonds’ average current duration is around 3.7 years, versus 7.9 years for investment grade bonds—just shy of its record high. With the differential near its widest on record, it’s not a big leap to conclude high grade credit will be particularly vulnerable to interest rate shifts, especially now that tight spreads provide less cushion to absorb higher rates.

Duration: High Yield vs Investment Grade Corporate Bonds

Investment grade debt is more susceptible to losses from rising rates

Source: ICE BofA. As of 31 Mar 2020. Based on modified duration. Modified duration is a measure of responsiveness of a bond’s price to changes in interest rates.

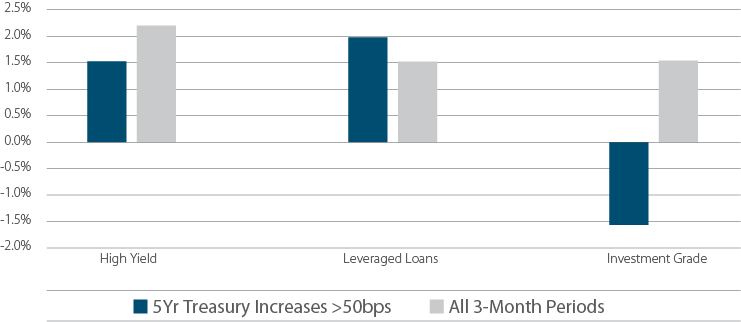

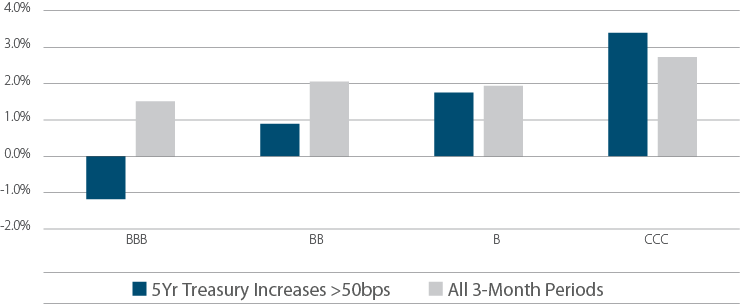

History bears this out: There is a clear inverse relationship between credit quality and interest rate sensitivity. During short periods when Treasury yields have increased rapidly, lower-rated credit has been resilient. CCC-rated bond returns in particular have a strong inverse relationship to Treasury yields—likely driven by the idiosyncratic nature of the bonds in the CCC rating bucket, their shorter duration and their reliance on improving economic conditions.

Returns by Asset Class During Rising Rate Periods

Median 3-month returns when 5-Year Treasury yields have increased more than 50bps

Source: Artisan Partners/ICE BofA/Credit Suisse/Bloomberg. Based on returns for the ICE BofA US High Yield Index (High Yield), ICE BofA US Corporate Index (Investment Grade) and Credit Suisse Leveraged Loan Index (Leveraged Loans) for the period December 31, 1996 to February 28, 2021. Past Performance is not a reliable indicator of future results.

Returns by Credit Quality During Rising Rate Periods

Median 3-month returns when 5-Year Treasury yields have increased more than 50bps

Source: Artisan Partners/ICE BofA/Credit Suisse/Bloomberg. Based on returns for constituents in the ICE BofA US High Yield Index and BBB-rated constituents in the ICE BofA US Corporate Index for the period December 31, 1996 to Feb 28, 2021. Credit ratings typically range for quality from AAA (highest) to D (lowest) and are subject to change. The ratings apply to underlying index constituents. Past Performance is not a reliable indicator of future results.

And finally, leveraged loans are one of the few fixed income segments that directly benefit from higher rates through increased yield. Because of their floating feature, leveraged loans have little interest rate risk, and their prices are unlikely to decline like those of conventional fixed income assets when interest rates rise. Then, too, demand for loans tends to rise with interest rates. Loan yields may be tied to short-term interest rates, but loan prices tend to trade more in line with moves in longer-term Treasury yields. Even though loan coupons remain relatively unchanged with short-term rates still pinned near zero, the asset class has seen more than $8 billion of inflows so far this year, tightening valuations and benefiting returns.

Contact the Editorial Staff

Have a question or comment? We welcome your feedback. Comments will not be made public, but will be read by a member of our editorial staff.

Thank you for your question or comment.