Important Information

This information is provided for general educational purposes only without regard to your particular investment needs. This material, including any attachments or hyperlinks, should not be taken as investment or tax advice of any kind whatsoever (whether impartial or otherwise) on which you may rely for your investment decisions, nor be construed as an offer, solicitation or recommendation for any investment strategy, product or service. Investors should consult their financial and tax adviser before making investments in order to determine the appropriateness of any investment discussed herein.

Material authored by any particular Artisan Partners individual or team represents their own views and opinions, which may or may not reflect the views and opinions of Artisan Partners, including its autonomous investment teams or associates. Statements are based on current market conditions and other factors, which are as of the date indicated and are subject to change without notice. While this information is believed to be reliable, there is no guarantee to the accuracy or completeness of any statement in the discussion.

All investments are subject to risk, which includes potential loss of principal. Past performance is not indicative of future results.

This material may reference index or other information that is subject to copyright by its respective service provider, including the following: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI. Frank Russell Company ("Russell") is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell's express written consent. Russell does not promote, sponsor or endorse the content of this communication. The S&P 500 and S&P UBS Leveraged Loan Indices are products of S&P Dow Jones Indices LLC (“S&P DJI”) and/or its affiliates and has been licensed for use. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, Inc. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). None of S&P DJI, Dow Jones, their affiliates or third party licensors makes any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2025, J.P. Morgan Chase & Co. All rights reserved. Source ICE Data Indices, LLC, used with permission. Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and, along with the ICE BofA trademarks, has been licensed for use by Artisan Partners Limited Partnership. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See www.artisanpartners.com/ice-data.html for a full copy of the Disclaimer. The index(es) are unmanaged; include net reinvested dividends; do not reflect fees or expenses; and are not available for direct investment.

© 2025 Artisan Partners. All rights reserved.

Is Japan Back?

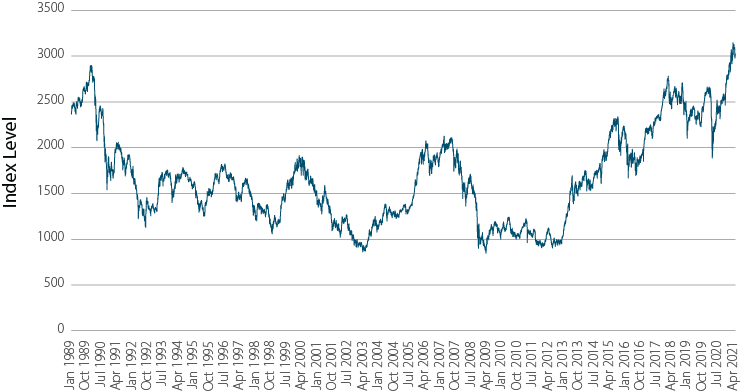

Perhaps you missed it, but Japan’s equity market is back to levels not seen since before its 1991 crash and subsequent lost decade—arguably decades. In March, the Topix Index reached a 31-year high and has since held up relatively well despite a resurgence in COVID-19 cases, a seemingly slow start to vaccinations, renewed business restrictions, an earthquake in February and the decision to hold the Tokyo Olympics at least without fans from abroad and possibly without any at all.

Japanese Stocks Finally Recover

TOPIX Index

Source: Bloomberg. As of 28 April 2021. Past performance is not indicative of future results.

The return to such heady levels raises some important questions—namely why, what does it mean for Japan and can the good times keep on keeping on for investors?

A strong economic rebound in the second half of 2020—at home and among key export markets such as the US—supported a similarly impressive rally in Japanese stocks. Real GDP rose at annualized rates of 22.8% and 11.7% in the third and fourth quarters, respectively. A “Zoom Boom” helped drive demand for personal technology devices, while Chinese and US vehicle sales bounced back strongly, driving Japanese exports.

The recent resurgence of COVID-19 and a global semiconductor shortage—exacerbated in Japan by an auto-chip factory fire—most likely drove the economy to contract in Q1. But there is widespread optimism for a rapid bounce back—albeit one not nearly as eye-popping as last year’s. The latest economic tea leaves largely validate the optimism. Recent labor market, export and foreign machinery orders data, as well as the Tankan large business survey have been generally favorable. Even retail sales were rebounding strongly prior to the worst of the latest COVID-19 resurgence.

Markets are also closely watching the current earnings season for the final quarter of Japan’s 2021 fiscal year. Perhaps more important than the quarterly numbers will be corporate guidance for FY 2022 and any outlooks for a post-pandemic recovery.

At the same time, some companies may feel compelled to mention corporate governance initiatives as Japan’s Financial Services Agency looks to further strengthen its corporate governance code in the areas of board independence, diversity and ESG. This comes on top of greater pressure for companies to disentangle complex cross-shareholdings arrangements—a characteristic of the country’s keiretsu system. Genuine efforts to improve corporate governance would be welcome news to investors.

An upbeat economic outlook, potential for solid earnings growth during a post-pandemic recovery and the possibility of more corporate governance progress seem like a promising recipe for further Japanese market gains. And perhaps that could be the case in the near term.

However, other challenges still seem overwhelming and bode ill for a genuine return to Japan’s glory days. Foremost is Japan’s demographics—in 2019, before COVID-19, Japan’s death rate exceeded its birthrate by more than 500,000. Genuine, material and rapid structural reforms are also needed as Japan’s productivity and position as a leader in technological advancement have been on the decline. And there is the Bank of Japan’s expansive monetary policy: Besides doing little to stimulate inflation and pull Japan out of its economic doldrums, the central bank is now the largest single owner of Japanese stocks thanks to its years of purchasing Japanese equity ETFs. The BoJ could face some significant challenges whether or not it tries to unwind its ETF purchasing program.

There is hope the pandemic could provide the shock and political cover Japan needs to make serious structural reforms. But if it doesn’t, Japan’s equity market resurgence could prove fleeting—and that would hardly be the country’s biggest problem.

Contact the Editorial Staff

Have a question or comment? We welcome your feedback. Comments will not be made public, but will be read by a member of our editorial staff.

Thank you for your question or comment.