Growth Team Weekly Investment Insights

1) The Shift from EVs to Hybrids

A recent Financial Times article explains how Toyota has been hesitant to significantly invest in fully electric vehicles (EVs) over the past few years, favoring hybrids instead. Its reasoning has been fully electric cars have been too expensive for consumers and charging infrastructure has not developed enough. It looks like it was on to something, at least in the short term. Sales of Toyota’s hybrid vhicles climbed by almost 1mn vehicles to 3.4mn last year.

Most of the industry continues to believe in the long term shift to EVs, but are pivoting their short-term plans. Now domestic manufacturers are racing to catch up to be part of the US hybrid market currently dominated by Toyota, Honda, Kia and Hyundai.

- General Motors, which had largely phased out plug-in hybrids, said it would reintroduce the technology as it acknowledged that customers were taking longer than expected to embrace fully electric models.

- Ford predicts its sales of hybrids will surge 40% this year, double last year’s pace. It sold more than 52,000 Maverick pick-up trucks in 2023, making it the fifth best-selling hybrid in the US after models from Toyota and Honda.

- “Our data shows that EVs are a clear destination for many customers . . .[but] it’s going to take more time than we expected 18 months ago,” Ford chief executive Jim Farley told investors this month. “Hybrids will play an increasingly important role in our industry’s transition and will be here for the long run.”

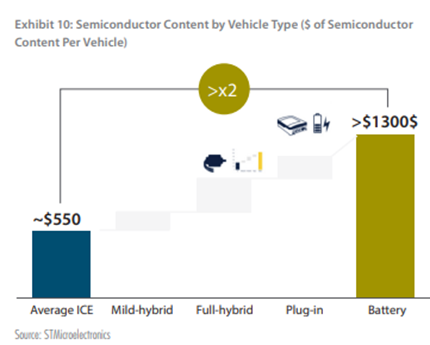

In our recent semiconductor paper, we highlighted the growing semiconductor content within cars and one of the driving forces is electrification. As standard internal combustion engine cars transition to hybrids, plug-in hybrids and full electric vehicles, the dollar amount of semiconductor content increases.

2) The Rising Popularity of Formula One

This article highlights Liberty Media's $8bn purchase of F1 in 2017 and its mission to grow the sport’s popularity, particularly in the United States. So far, Liberty has largely succeeded, partly thanks to the hit Netflix documentary series, Drive to Survive, which brought the drama of the sport to a new audience of Millennials and Generation Z.

- The average age of the sport’s followers consequently dropped from 40 in 2018 to 37 four years later, Liberty told investors last year.

- Fans are not just getting younger—women and girls represented 40% of the fan base in 2022, a jump from 32% in 2018, according to F1.

- Ford and Audi have agreed to join F1 from 2026, key endorsements from the automotive industry.

- Last year’s United States Grand Prix in Austin, Texas, drew 432,000 visitors over three days—up from 268,000 before the coronavirus pandemic.

- The events in Miami and Las Vegas drew 270,000 and 315,000 visitors in 2023.

Last year, a stake was purchased in Aston Martin F1 at a valuation north of £1bn, versus the £90mn that a consortium led by Canadian billionaire Lawrence Stroll paid to take the former Force India team out of administration in 2018. The jump in team valuations reflects the transformation across F1 since Liberty Media took over.

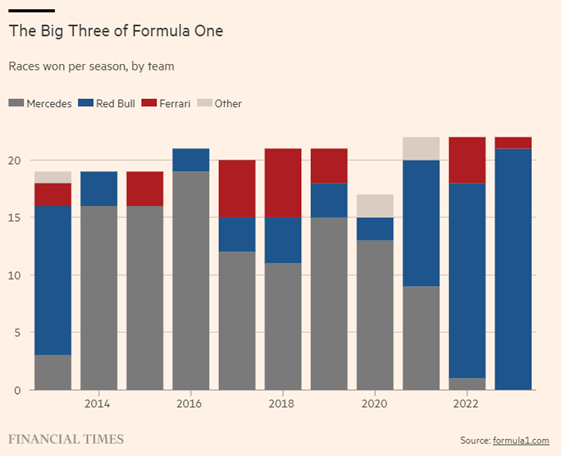

Another goal from Liberty has been to level the playing field. One initiative has been introducing limits on how much teams can spend, including on developing their cars. However, so far, the top of the leaderboard continues to be dominated by the same teams (Red Bull, Ferrari and Mercedes) and reigning champion Max Verstappen of Red Bull Racing won a record 19 out of 22 races last season.

3) Spreads are Reaching Historic Levels

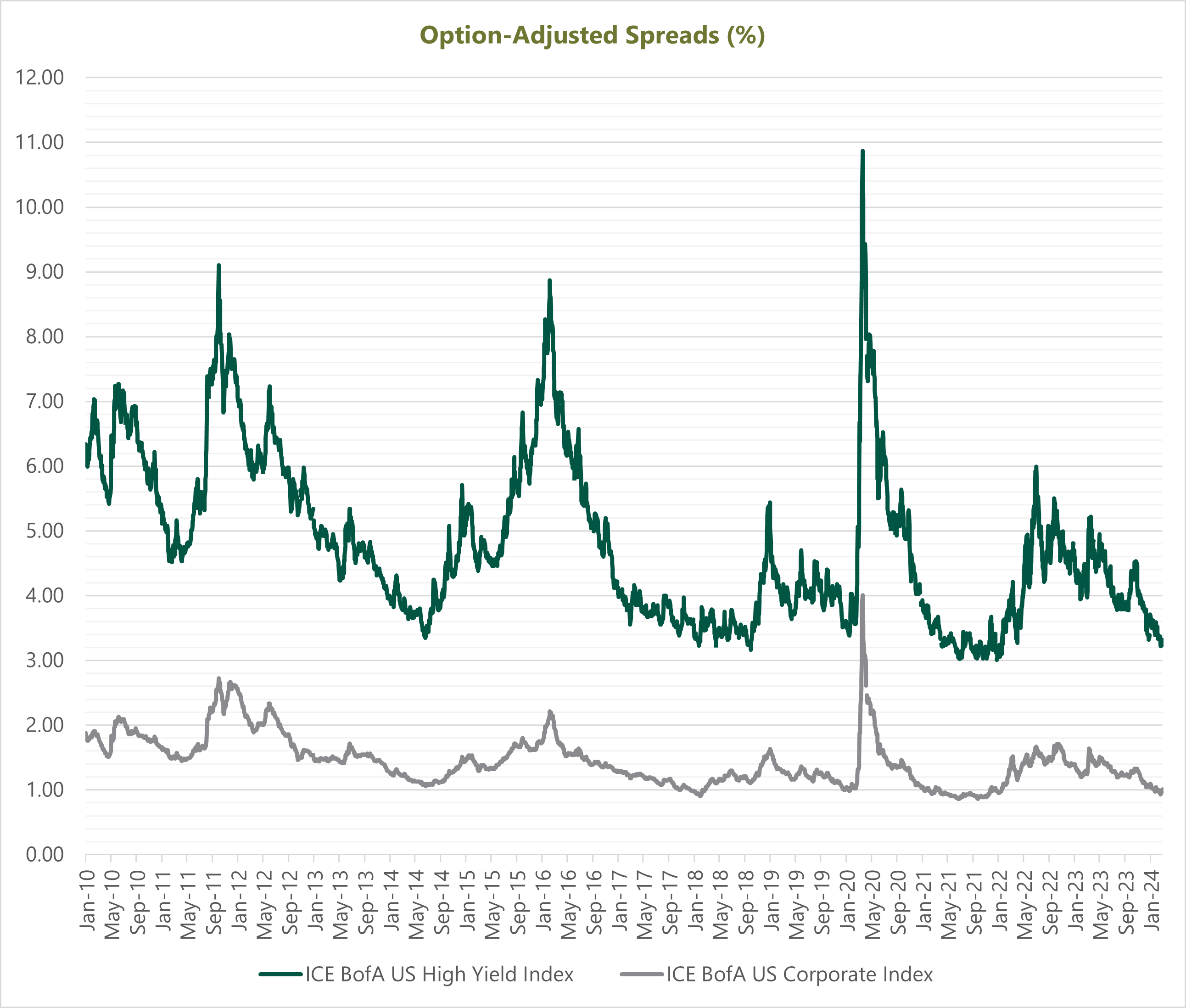

The extra yield that investors demand to hold corporate debt over Treasurys has been compressing to some of the lowest levels since the Global Financial Crisis (GFC).

The recent peak for high yield spreads was on October 27 of last year at 453bps. As of March 1, spreads have compressed to 332bps, which is within striking distance of 301bps, the lowest level since the GFC.

Source: Federal Reserve Bank of St. Louis, as of 3/1/2024

4) “The Next Big Opportunity After Obesity”

Last week, the WSJ published the article “Are Alternatives to Addictive Opioids on the Way?” The opioid epidemic has led to an increasing hesitance among doctors to prescribe those medications. However, there aren’t any good alternatives to help the ~80 million Americans prescribed medicine for moderate-to-severe acute pain each year.

This creates a significant opportunity for companies that figure out an option that provides similar pain relief without the addictive element of opioids. One such company is Vertex Pharmaceuticals, which recently released positive clinical trial results for its drug, VX-548, and will be looking to file for FDA approval by mid-year.

The results for Vertex’s drug were not a home run compared to opioids but are a step in the right direction, paving the way for better drugs in the future.

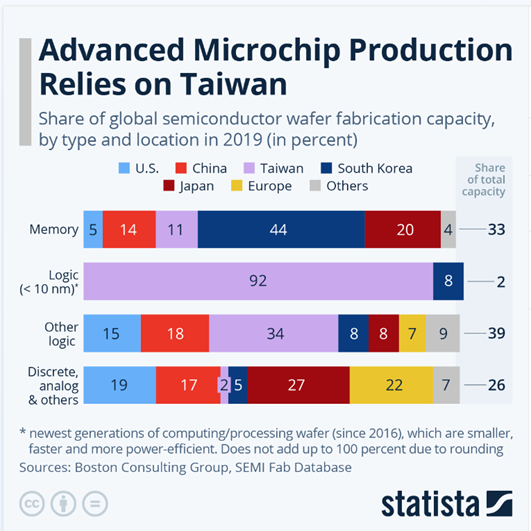

5) Semiconductor Industry Concentration at the Leading Edge

A few weeks ago, we highlighted the semiconductor foundry concentration in Taiwan, South Korea and China. This graphic takes it a step further by displaying how Taiwan controlled more than 90% market share in the production of leading edge (<10 nanometer) chips as of 2019.

These concerns have resulted in a global focus to bolster onshore manufacturing. The US passed the “CHIPS and Science Act,” the EU passed the “European Chips Act,” Japan announced a multi-billion-dollar initiative to boost its domestic chip industry and China cited the semiconductor industry as a key area of focus in its updated Five-Year Plan.

Source: Statista. https://www.statista.com/chart/30041/global-semiconductor-wafer-fabrication-capacity-by-type-and-location/

Artisan Growth Team manages portfolios which held securities issued by Liberty Media Corp Liberty Formula One and Vertex Pharmaceuticals as of 12/31/23. Portfolio securities are subject to change.

Contact the Editorial Staff

Have a question or comment? We welcome your feedback. Comments will not be made public, but will be read by a member of our editorial staff.